Unleash predictive and prescriptive analytics that drive stronger performance.

- Gartner client? Log in for personalized search results.

Finance Analytics: Use Data for Better Business Decisions

Gain forecasting agility with finance analytics

Nearly two-thirds of board directors say their organizations are becoming more digital. In response, finance leaders must take action to drive digital strategies. One way to do this is to harness finance analytics to provide executives with better information.

Download our guide to:

Develop a finance data and analytics strategy

Expand FP&A’s scope to maximize business impact

Evolve finance and business digital partnerships

- Accelerate AI in finance

Drive success with a future-ready finance analytics strategy

Today’s finance leaders need to know what might happen next — and what to do about it. Finance analytics provides the answers. Build a solid foundation for data analytics success in the following areas.

- Metrics and Storytelling

- Finance Reporting

- Advanced Analytics

- Governance

Boost D&A impact by mapping finance analytics investments to business outcomes

Delivering new, digital finance analytics capabilities requires a clear way to align data and analytics (D&A) investments with business outcomes. Driver mapping can fulfill this need by mapping financial planning and analysis (FP&A) activities to decision makers’ information needs.

Driver maps serve a wide range of organization types, from complex enterprises, government and not-for-profit organizations, to business units, operating regions, product lines and projects. Driver maps serve multiple purposes, including:

D&A strategy. A driver map visualizes the ways your business creates and delivers financial or strategic value, identifying high-value analytics projects that should be prioritized in your finance analytics strategy. Some teams have used driver maps to source feedback on analytics model design or to educate business leaders to make more financially informed decisions.

Metric and KPI selection. Though every KPI is a metric, not every metric is a KPI. Use your team’s strategic fluency and familiarity with currently reported metrics to develop a working draft of KPIs, and share it with outcome owners and decision makers. This approach eases the challenges of engaging leaders as co-creators in the process and minimizes the risk of having too many metrics.

The realities of the data provisioning process should also influence metric selection. Driver mapping helps by separating the conversation of “what needs to be measured” from “how that should be measured.” This allows the inclusion of KPIs and metrics that involve factors beyond relevance alone, such as data quality, latency, effort and timing.

- Self-service dashboard design. Intuitive dashboards are essential to self-service reporting — and a driver map provides the outline. Each strategic or operational driver can map to a tab in a self-service workbook, with contextualizing data displayed on-page. The map defines the drill-down and click-through relationships that need to be established in the dashboard, which can save reporting teams months of iteration and rework.

- Conceptual data modeling. A driver map is an exercise in mapping data relationships and the data sources needed to produce reports or analyses. In the hands of IT partners, a driver map is a blueprint for data models that are easy to use for analysts and report creators. The driver map can also help keep data lineages organized and well governed.

- Data governance. A driver map offers a means to scope and prioritize business value outcomes, decision models, D&A processes and data assets in need of data quality improvements. This perspective improves your team’s ability to explain to business leaders how governance activities will affect operations.

Rethink dashboard design to create a high-value analytics reporting experience

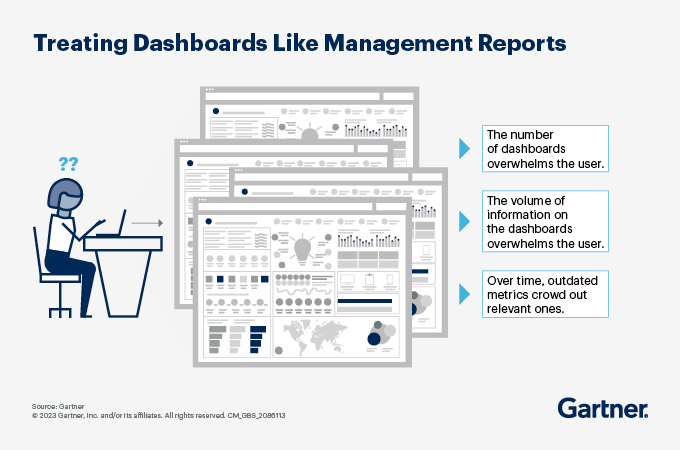

According to 56% of senior finance leaders, dashboards are not currently able to support better decision making. Rather than serving as an adaptation of more extensive and in-depth management reports, an effective dashboard communicates key insights concisely and quickly to support finance decision making.

To best support your decision making, align the finance organization’s thinking to what dashboards are meant to do and how to best design them. Start with the following actions:

Differentiate dashboard capabilities and use cases from management reporting. A dashboard visually tracks, analyzes and displays key performance indicators (KPIs), metrics and key data points to monitor the health of a business, department or process. Outline your strategic vision for dashboards, which should include the following characteristics:

More frequently updated data. Dashboards update automatically (though not in real time), making them much more current than management reports, which only provide a snapshot of backward-looking performance.

Narrow use cases. Dashboards serve specific missions, such as tracking performance or explaining the root causes of performance issues, while management reports give a comprehensive view of a company’s financial situation.

Broader audience. Both dashboards and management reports inform the decisions of senior leaders, but in practice, dashboards have a wider reach and can be used by anyone who is interested in the dashboard’s specific KPIs.

Interactivity. Dashboards are dynamic tools requiring active user engagement, while management reports are static.

Unique features. Dashboards offer the ability to get a bird’s-eye view of the data and drill down into specific metrics and their drivers, automated alerts, and data sharing/collaboration features absent from management reports.

Align the dashboard to decision makers’ thought processes. Require dashboards to center around one specific business question or problem, excluding any metric irrelevant to that question or problem. Once the question or problem is established, require analysts to undergo a decision-mapping process to understand how a user thinks through a given business problem, and adjust dashboard design accordingly.

Also, interview stakeholders to understand what question or problem they need to address and how they approach that question or problem. Outline a scenario where a critical KPI is exhibiting variance to a key decision maker and ask questions such as:

What factors drive this KPI’s underperformance?

What metrics do you associate with those factors?

What is the relationship or interplay between these factors?

Set up dashboard governance to avoid sprawl. Dashboards are built for long-term use and are constantly updated. Consequently, unlike management reports, dashboards tend to increase in size and complexity, and their relevance may erode over time. Adequate oversight will preserve dashboard usability.

Dashboards are better suited than management reports in certain situations, but not all. Set clear guidelines for when to use each of these formats.

Understand the use cases for predictive and prescriptive analytics

Increasing data volumes, business complexities and growing uncertainties require a quick shift from manual to advanced and augmented analytics. This means carefully designing processes to fully leverage digital capabilities and safeguard the integrity and quality of machine outputs.

Predictive and prescriptive analytics are key to this evolution. These AI- and ML-based analytics are growing areas of investment in finance. Each requires different levels of technical sophistication, staff skills, organizational structures and FP&A maturity.

AI- and ML-driven advancements take finance analytics to the next level.

Three major categories of advanced finance analytics include the following:

Diagnostic analytics is a form of advanced analytics that examines data or content to answer the question, why did it happen? It is characterized by techniques such as drill-down, data discovery, data mining and correlations.

Predictive analytics is a form of advanced analytics that examines data or content to answer the question, what will happen? (Or, more precisely, what is likely to happen?) It is characterized by techniques such as regression analysis, forecasting, multivariate statistics, pattern matching and predictive modeling. Predictive analytics has already been deployed in most organizations and can be executed by existing staff with existing technology.

Prescriptive analytics is a form of advanced analytics that examines data or content to answer the question, what should be done, or what can we do to make X happen? It is characterized by techniques such as graph analysis, simulation, complex event processing, neural networks, recommendation engines, heuristics and machine learning. To deploy, prescriptive analytics typically requires additional resources, including staff, technical training and new technology investments.

As you build a strategy to leverage the capabilities offered by advanced analytics technologies, consider the following questions:

What analytics capabilities should we be investing in?

How do we develop an AI strategy in finance?

What are the best use cases for AI in finance?

How should we leverage AI/ML to deliver advanced and predictive analytics?

How should we evaluate and quantify ROI for our analytics initiatives?

Ensure secure, effective and efficient use of data with the right oversight

FP&A teams use larger varieties of data than ever before to:

Support increasingly scalable decision making.

Support democratized self-service analytics and reporting tools.

Develop next-generation extended planning and analysis tools into more cohesive, composable platforms

Yet through 2025, poor data quality will remain one of the most frequently mentioned challenges prohibiting advanced analytics deployment.

Legacy approaches to D&A governance are no longer practical

As AI technology emerges, decision makers need more enriched and real-time analytics. But for many finance teams, data quality is too insufficient to provide decision makers with actionable insights, and enterprise stakeholders often lack the data skills or data literacy to resolve critical business problems.

Proper governance starts by addressing four key challenges:

Data integrity. Increased automation amplifies the need for methods and solutions that support strong data governance and reliable data. Technical solutions used to prepare, store and secure data quality can help ensure the uniformity, accuracy and integrity of your enterprise data, and can facilitate data democratization.

Adoption of advanced analytics/AI. The emergence of AI and machine learning (ML) solutions creates a need for new governance frameworks. Solutions like augmented data management, AI governance and D&A governance platforms make it possible to create and enforce consistent governance rules for safe AI building and deployment.

Decision support. A growing number of decision makers require broader analytical contexts, supported by more granular financial and nonfinancial data. Introducing ungoverned nonfinancial data can create ambiguity. Innovations like semantic search or responsible AI help add context to reduce bias, even if a certain level of bias is present in the data.

Data-driven culture. Every organization’s technology investments should aim to develop a data-driven culture. Leverage data literacy assessments and stewardship programs to address technological and skills gaps. Doing so will help secure quality D&A, minimize investment risk and avoid eroding partners’ trust.

Document data lineage as part of a modern data governance strategy

Today’s reports and analysis draw data from multiple disconnected systems subject to various alterations along the way. Without proper transparency of data lineage, consumers frequently mistrust, misuse or ignore relevant and actionable D&A in decision making. This is especially problematic when decision makers have strong prevailing opinions or beliefs and new reporting and analysis tools offer insights contradicting these beliefs.

FP&A teams often sit at the hub of data and analytics insights, giving them a strong comparative advantage in documenting data lineage. By documenting data lineage and offering visualizations on how data flows from source systems through reporting and analytics tools, your team can:

Be better positioned to respond to consumers’ questions like, “Where did that number come from?” or “What happened to this number along the way?”

Avoid unproductive, non-value-added time spent dissecting reporting, or self-service analytics and business intelligence tools to defend insight accuracy

Give stakeholders tools to research the sources of data and create reports on their own

Gartner CFO & Finance Executive Conference

Be a part of most important gathering for CFOs to explore potential finance tech providers and get actionable insights to prioritize technology innovation.

FAQ on finance analytics

What is finance analytics and why is it important?

Finance analytics provides insight into the financial performance of an organization by using accounting and finance data, typically based on historical enterprise financial transactions, to discover and understand patterns. These patterns enable the organization to predict and improve business performance and guide decision making.

What are the benefits of using finance analytics?

Finance analytics improves the business’s understanding of performance drivers, opportunities, risks and course corrections. Doing so is key to improving the financial soundness of business decisions and achieving finance’s objective of being a trusted advisor to the business.

What is the future of finance analytics?

Finance leaders have a unified vision for a digital-by-default finance function with a highly scalable structure, finance data available on demand and a high concentration of digital and decision support skills. But only 23% of finance leaders are satisfied with progress on current initiatives related to real-time commercial analytics.

Realizing the future of digital finance analytics will require forward-looking transformation actions that will allow finance to maximize the unique value it can offer the organization.