Build a solid foundation for evaluating, implementing and optimizing artificial intelligence in finance.

- Gartner client? Log in for personalized search results.

AI in Finance: CFO Strategies for Successful AI Deployment

▶

▶

What leading AI finance organizations do differently

AI in finance is growing quickly, yet only 30% of finance functions we surveyed are considered “leading AI finance organizations.” Download our guide to learn:

The four criteria that define today’s leading AI finance organizations

The four key actions that leading CFOs take to set a firm foundation for AI success

How you can achieve success in your own finance AI initiatives

Key elements of a solid finance AI strategy

Leading finance organizations exhibit a common pattern of actions and decisions that result in significant returns on AI initiatives. CFOs of these organizations focus on four critical areas.

- Draw Data Science Talent

- Support AI Transparency

- Shape GenAI Strategy

- Accelerate AI Adoption

Fill critical AI finance roles with the right internal and external candidates

Only 10% to 30% of organizations report that they’ve realized significant financial benefit from artificial intelligence. Insufficient skills and employee acceptance are two of the top 3 leading causes for low returns on AI.

Leading CFOs look to the AI generation — data science talent who are developing, deploying or championing the first wave of AI solutions — to fill the roles that contribute to successful finance AI deployments.

Identify members of the AI generation

Organizations that attract and develop talent from the AI generation will avoid significant challenges in productivity, team culture, employee engagement and retention. To identify members of the AI generation, look for these common traits:

They consider digital- and AI-enabled solutions first when solving problems.

They view coding and analytics as basic life skills.

They prioritize employment based on opportunities to further develop data science skills in support of meaningful work.

To attract this key talent, AI-forward CFOs adjust their recruitment strategies, develop new career paths and invest in data science technologies and development opportunities for current staff. These CFOs also adjust their hiring focus to create talent pipelines and develop trainings for candidates with nontraditional finance backgrounds.

Rebrand finance to recruit the AI generation

Finance faces a branding problem with the AI generation. Many data science professionals still view finance as a necessary but uninteresting back-office function.

Successful CFOs build a strong employee value proposition for AI generation candidates by investing in the following activities:

Promote meaningful work. Members of the AI generation are often motivated to solve the puzzles behind high-impact problems. Design workflows and projects structured as puzzles and pilot explorations, and develop a strategy for pilots to demonstrate commitment to employees and candidates.

Establish a high-quality data environment. For any D&A professional, the data environment can be as important as the work environment. The AI generation does not want to fix data problems; they want to use data to craft solutions. Building a data management team (comprising data engineers, a data governance manager and DataOps professionals) is a necessary enabler for data science professionals.

Invest in best-of-breed technology. In the 2022 Gartner Modern Digital Finance Talent Survey, 71% of all finance workers said it was important that their organizations worked with the latest technology. A modern, composable finance technology strategy should be a priority for CFOs and FP&A leaders.

Foster technical skills development opportunities. A majority of developers (59%) rank the opportunity to learn new technical skills as their most important professional growth priority. Successful finance organizations incorporate technical skills expectations in competency models, develop training offerings such as analytics communities of practice, and fund access to external development programs where necessary.

Position finance for AI success by maintaining the human-machine learning loop

AI’s human-like outputs may seem like an obvious benefit to a productivity-minded manager, but employees perceive artificial intelligence as an employment threat. Our research revealed that 70% of the active workforce believes AI can replace people — so it’s not surprising when new AI-driven solutions are rejected and fail to gain traction.

Blindly handing over responsibility to a machine is not just uncomfortable, it’s unadvisable. AI-supported processes must support a transparency that allows people to observe the process and freely take control when necessary.

CFOs looking to successfully deploy AI in finance should take the following actions:

Keep humans in the loop. AI algorithms do not match the full awareness and competency of people. The complexity of delivering unbiased and valid financials demands that people remain engaged in the automation loop. AI-forward finance functions design AI-driven processes so that automated steps and decisions are observable and that people can interrupt an automated process and supplement actions with human judgment.

Position AI as a co-worker. Employees who perceive AI as a co-worker that helps them with their work feel more engaged and aren’t threatened by a technology some perceive as an adversary. Leading organizations emphasize AI solutions that improve personal productivity. They prioritize using artificial intelligence to help individuals do their jobs better rather than using AI to improve the productivity of departments or functions. These organizations are six times more likely to succeed with their AI initiatives, and their employees report a threefold level of job satisfaction.

Segregate the strengths of people and machines. Successful finance teams design processes so that people and machines are each tasked with the actions they perform best. These organizations recognize that AI performs some narrowly defined tasks better than people, but it cannot do everything better. In many cases, tasks that people perceive as simple are nearly impossible for a machine to replicate.

Building processes to promote the strengths of people and machines, while avoiding their respective weaknesses, introduces a new collaboration that improves business performance and employee satisfaction.

Lead cross-organization conversations around generative AI’s impact

The recent entry of large, well-established companies into the generative AI market has kicked off a highly competitive race to see who can deliver revolutionary value first. The market is pushing the limits of what is possible. But in the rush to exploit this new capability, companies must consider the risks and impacts of using AI-driven technology to perform tasks that, until recently, were exclusively reserved for humans.

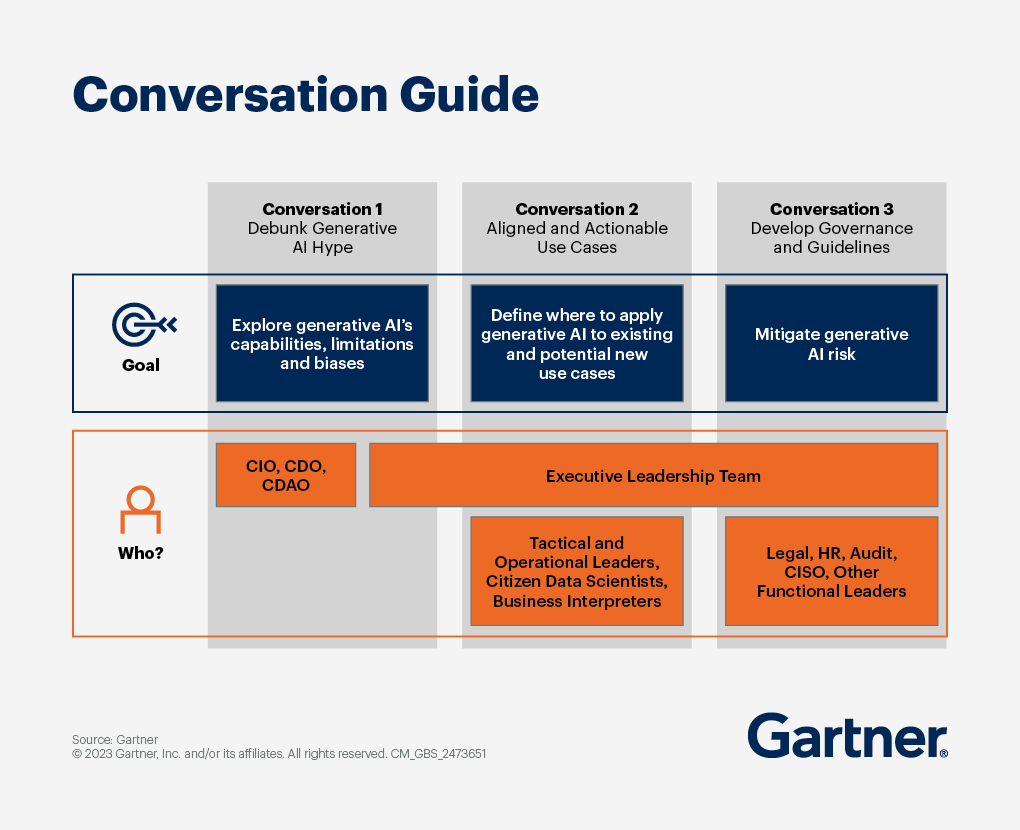

As the chief steward for an organization’s financial health, the CFO must balance the risks and rewards of tools like generative AI. Three distinct conversations across leadership circles will help CFOs establish reasonable expectations and ensure that the use of generative AI creates value without introducing unacceptable risks.

Conversation 1: Debunk the hype around generative AI

Despite its remarkable potential to help finance organizations navigate complex, high-volume data, generative AI’s limitations introduce real challenges that CFOs must raise when considering use of generative AI in finance and across the organization. Successful CFOs partner with senior technology leadership (e.g., the CIO, chief data officer, chief information security officer) to distinguish hype from reality, and then share the results of those conversations with other executive leadership team members.

Conversation 2: Define aligned, responsible, actionable use cases for generative AI

With an understanding of generative AI’s limitations, CFOs can responsibly direct a conversation with operational management, executive leaders and representatives from the user community to define the following:

Actionable generative AI use cases that align with their organization’s overall strategy and risk tolerance

Generative AI’s effect on current strategies, projects or investments

As with any artificial intelligence solution, the best use cases exploit a specific business’s strengths and defend its weaknesses. Aligning generative AI’s fundamental capabilities to your business’s unique strategies and objectives delivers a value that differentiates your company from its competitors.

Conversation 3: Develop generative AI governance and guidelines for acceptable use

Generative AI’s capabilities require organizations to mandate a set of guidelines that reflect new risks and opportunities. Progressive CFOs engage legal, HR, audit, security and other relevant corporate support functions to:

Ensure ethical usage and reduce detrimental reliance on algorithms that may not always be accurate

Minimize legal and compliance risk

Establish transparent and responsible deployments

Safeguard against damaged reputation and financial misstatements

Verify results

Understand the potential impact to the workforce, company culture and necessary training

Build finance AI use cases by learning from early internal and external adopters

Sixty-one percent of finance organizations we surveyed are not currently using AI. Either they are still in the planning phase for AI implementation, or they don’t have a plan at all. Only 9% are currently using and scaling AI. This places finance behind other administrative functions (i.e., HR, legal, real estate, IT and procurement).

Finance leaders whose functions are not yet using AI cited four primary reasons: other priorities, lack of technical capabilities, low-quality data and insufficient use cases.

The last three reasons — technical skills, data quality and insufficient use cases — are related to workflow and capability. But the most commonly cited reason for not using AI in finance is that finance leaders have “other priorities.” This speaks to an important aspect of finance leaders’ beliefs about AI — that it is a discrete project that would need to be added separately to their function’s transformation roadmap.

This perspective falls short of reality, in that AI can be a critical enabler of finance’s “priorities” — such as more dynamic financial planning or close and consolidation efficiency.

Across a diverse set of areas, 64% of finance organizations using AI report that its impact has either met or exceeded their expectations. These CFOs can expect this impact to compound as their more complex AI techniques mature and provide greater value in Year 2 or 3.

Our recent survey shows that four out of five finance leaders anticipate the cost and effort they allocate to deploying AI within finance will increase over the next two years, with 52% of these leaders anticipating cost and effort to increase by more than 10%.

As you begin to chart out a plan for how best to prioritize that additional investment, partner with your finance leadership teams to compare their current progress against that of their peers and identify concrete recommendations from early adopters on how best to accelerate AI use in their function.

Gartner CFO & Finance Executive Conference

Be a part of most important gathering for CFOs to explore potential finance tech providers and get actionable insights to prioritize technology innovation.

FAQ on AI in finance

How can AI solve real challenges in the finance function?

The value of artificial intelligence comes from improving the finance function’s ability to predict, analyze and uncover important patterns from unstructured data, and thereby automate work, make informed decisions, compute large quantities of information (including unstructured data) and avoid risk.

What should CFOs consider when implementing AI in finance?

Unlike automation software that can do simple, rote tasks, artificial intelligence performs tasks that historically could only be handled by humans. This positions artificial intelligence as more of a co-worker than other technologies. But despite AI’s capabilities, finance has unique responsibilities — such as validating the integrity of financial statements — that can’t be delegated to an algorithm.

When building AI-driven processes in finance, CFOs should consider how to design solutions with total transparency so that responsible humans can remain fully informed and accountable.

How can CFOs prepare their teams for finance AI adoption?

It’s critical to create a culture that embraces and trusts AI. Progressive CFOs position finance for AI success by implementing the AI-Forward Framework — a structured approach to adopting AI in finance. The framework includes the following components:

Developing an organizational AI competency

Defining business drivers and automating the collection, correction and distribution of data

Purchasing software platforms with embedded AI finance features

Championing AI initiatives and communicating AI’s benefits