Accelerate digital finance initiatives across your function to achieve an autonomous future.

- Gartner client? Log in for personalized search results.

Digital Finance: Trends, Insights and Strategies for CFOs

Evaluate your function’s digital finance progress

Gartner Digital Finance Score enables your organization to identify opportunities and improve performance by assessing the maturity and importance of a broad set of functional activities.

Download the sample report to:

Measure the maturity of key digital activities

Prioritize areas of improvement

Plot your function’s path to improvement

This is an excerpt from a full report.

Build a digital finance transformation strategy that delivers

CFOs have a broad vision for an automated, AI-enabled finance function, but nearly 70% of transformation projects are moving slower than expected. Progressive leaders accelerate on five key areas.

- Digital Strategy

- Finance Technologies

- Digital Operating Model

- Data and Analytics

- Digital Finance Talent

Focus your digital finance strategy on innovation, investment and culture

To enable the type of digital finance transformation that CFOs envision, finance functions align to a digital finance strategy that emphasizes innovation. Two areas clearly stand out as the most common barriers to innovation:

Employees are too focused on immediate goals to find time for innovation. Failure to help employees see beyond their immediate goals to focus on innovation is the top reason for limited innovation success. Conversely, organizations with high innovation maturity are almost six times more likely to be effective at organizing time and resources for innovation activities.

Organizational silos make collaboration difficult. Nearly one in two business leaders cite limited collaboration as a top innovation barrier. When teams experiment, test or implement something new, they typically need help, expertise, perspective or buy-in from other parts of the organization.

When managing digital change, you must increase employee understanding and buy-in for innovation by reinforcing the finance transformation vision and clarifying how staff should focus their time. Also, break down silos by creating internal workflows that support increasingly horizontal and agile ways of working.

A successful digital strategy also requires knowing how to prioritize spending on digital technology. Our survey of more than 500 finance leaders revealed that business objectives related to performance and profitability were the biggest drivers of finance tech solution purchases. With so many rapid advancements in digital technology, prioritizing digital spend requires a deep understanding of solutions in the market as well as vendor capabilities and how the market is expected to evolve.

In addition to fostering innovation and carefully prioritizing technology investments, successful digital finance transformation leaders build a digital finance culture from the top down.

Building a digital culture requires setting clear expectations for the entire finance leadership team that all leaders must actively and continuously develop their personal digital leadership skills. In particular, emphasize that leaders must be proficient at developing their teams’ digital delivery skills and developing personal proficiency at leading technology delivery initiatives.

Learning and development is critical to successful digital finance transformations — specifically opportunities tailored to various audiences and clearly connected to transformation objectives. Plus, the importance of change management — balancing transformation initiatives with daily responsibilities, mitigating change fatigue and helping employees adjust to new ways of working — can’t be overstated. Change management must be embedded in all aspects of a digital finance transformation strategy.

Create a roadmap that optimizes and increases returns on technology investments

The growing importance of finance technology in delivering better business outcomes is driving CFOs to become directly engaged in the strategy, planning and execution of finance technology initiatives.

Eighty percent of CFOs are making “setting finance’s strategy and roadmap” a personal priority for next year, and 45% will focus on optimizing the finance technology stack.

But the quickly evolving landscape of finance technology makes traditional technology selection and implementation practices inflexible and outdated.

Ensure you stay abreast of technology and market insights, and validate your finance technology roadmaps with peer data when selecting new technologies and vendors. Focus on understanding how emerging technology trends can reshape the role of finance and future digital finance initiatives, and use that knowledge to:

Champion a composable technology strategy

Develop a framework for evaluating and selecting the right technology solutions

Build the finance organization’s IT capabilities to optimize those technology investments

Understand the technology and vendor landscape

The first step in technology selection is to understand the solutions in the market, vendor capabilities and how the market is expected to evolve. When considering new technology investments, do the following:

Clearly differentiate between the hype and the reality of the technologies under consideration.

Fully understand the value of adopting various technologies.

Determine which vendors to invest in by weighing their capabilities and evaluating them carefully during the RFP process.

Drive greater returns on digital investments

The finance function must own its future by owning its technology rather than relying on IT for it. To that end, many finance teams are considering establishing a finance IT team. To do this successfully, define the scope of finance IT based on business needs, identify the competencies needed for the team and create a staffing plan that clearly defines the value, structure, roles and responsibilities of a dedicated finance IT team.

Realize the benefits of a growing array of tech options

Instead of questioning AI and its value, seek out vendors and build skills to realize the benefits early AI adopters have already achieved.

Four themes emerge from recent digital finance technology innovations:

Decision support combines human intuition with modern technology to evaluate scenarios and drive sound decisions.

Process efficiency boosts teams struggling to deliver economies of scale.

Dynamic applications hide the complexity of managing an interconnected application landscape and simplify the effort of customizing platforms.

Data integrity increases the quality of data with minimal manual effort.

Build an operating model that supports a future-ready digital finance organization

Progressive CFOs ensure other finance leaders fully understand the scope of changes that genuine transformation requires. Using a digital operating model framework helps orient stakeholders to all the moving parts of large transformations.

No two companies or functions have identical operating models because of differences in business context, talent, regulatory environment and history. But it’s important to keep the following high-level themes in mind:

Future digital finance teams will work more like technology teams, in that most teams will have some responsibility for technology deployment, customization and ongoing management. This will require closer collaboration between finance and IT.

Machines will move beyond automated tasks to play a bigger role in judgment-based decisions and provide more prescriptive advice to humans.

All teams (not just corporate IT or finance IT) will need technology expertise as other areas of the organization begin to require deep engineering or software development skills.

The comparative advantages of the corporate finance center will grow, while the comparative advantages of regional teams are likely to narrow, as technology and standardization progress.

Central to building a digital operating model is the digital organizational structure. Most CFOs believe the number of digital finance talent in their ranks will only continue to grow, but this type of employee is scarce and expensive. The best way to organize your digital finance team depends on two factors:

Availability of digital talent

- The scale of digitalization in the finance function

Support “citizen digital talent” — digital talent that remains in nondigital roles — by creating a matrixed organizational structure that gives digital talent a secondary, dotted reporting line into a digital manager.

A successful digital operating model also extends flexibility to the technology portfolio. Where the traditional finance technology paradigm is designed around large complex systems, familiar vendors, and standard, inflexible design, future digital finance technology will include a composable architecture — one that increases modularity and flexibility and organizes technology into application building blocks that support specified business outcomes. Through 2024, 50% of financial application leaders will incorporate a composable financial management system approach.

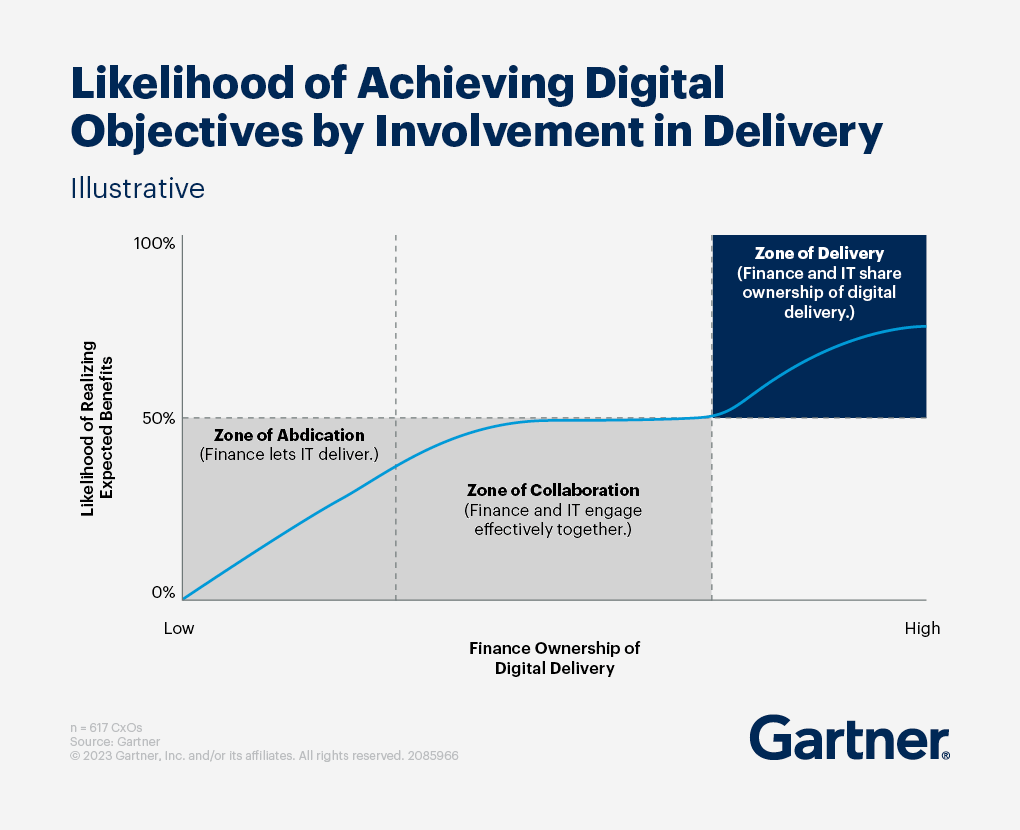

With large-scale transformation comes greater responsibility. Go beyond engaging with IT to collaborating on and co-leading digital delivery activity, which is defined as the actual creation or implementation and management of a digital system. Think: identifying and roadmapping technologies, working with technology vendors, developing or implementing a technology, ensuring security and compliance, managing the technology life cycle, and more.

Traditionally, finance’s relationship with IT has been fraught with friction because of perceptions of competing interests. This can impede critical decisions on digital investments. To overcome these perceptions, build and model an empathetic partnership with the CIO, driven by mutual discovery of common ground.

Establish metrics and governance frameworks that drive quality digital finance analytics

Finance leaders have a unique opportunity to capitalize on the growth of an analytically proficient talent pool and the rise of user-friendly AI-based tools that lower the technical barriers to adopting predictive and prescriptive analytics.

Finance metrics, insights and storytelling

In making the shift from reporting data and information to delivering insights, successful organizations deliver insights that business leaders understand, trust and use in their decision making.

To fully reap the benefits of AI and machine learning analytics capabilities, focus on the following:

Find the right metrics to evaluate business performance and digital transformation.

Tell more compelling and effective stories with data.

Improve data storytelling in digital, self-service environments.

Develop a metrics cascade to visualize for stakeholders the relationships between operating-level metrics and the organization’s strategic business outcomes.

Make performance metrics more forward-looking.

Data and analytics governance and data integration

The accuracy, timeliness and reliability of financial data are essential to successfully deploy the digital technologies and advanced analytics that support business decision making and data-driven insights.

To ensure proper governance and optimize data quality, take the following actions:

Break down traditional data silos, recognizing the interconnectedness of data and its importance in explaining the full story behind financial performance.

Adopt an enterprisewide, collaborative approach to D&A management, in which finance acts as a steward of financial data and a champion of technology-driven data governance.

Identify the data infrastructures that will best suit the organization’s needs.

Financial analysis, reporting and dashboards

Routine finance analytics, management reporting and business intelligence are foundational elements that deliver key financial information and insights to stakeholders. But to be truly useful for day-to-day decision making, the information and insights need to help decision makers understand and diagnose business performance.

To make the highest and best use of digital reporting capabilities, focus on the following activities:

Reduce the manual effort required to produce analytics and reports.

Understand and implement best-in-class management reporting practices.

Develop self-service dashboards — and optimize their impact — by defining use cases based on the end users’ seniority and familiarity with the decisions the dashboard supports.

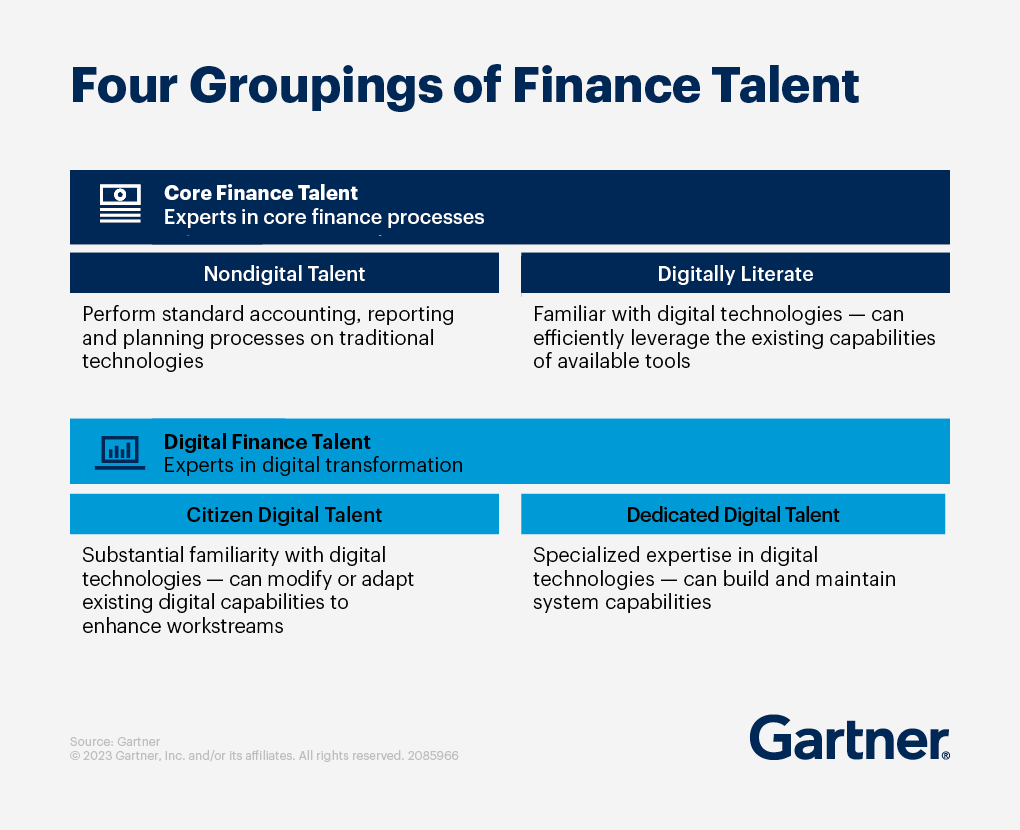

Prioritize efforts to attract, develop and retain top digital talent

Having the right set of skills and expertise will be critical to executing digital transformation. CFOs estimate that, on average, only 17% of their finance staff could be considered digital finance talent. But they aim to expand that talent pool to 46%, on average, by 2027. CFOs who build their own teams’ ability to deliver digital capabilities are significantly more successful than those who exclusively depend on IT.

To build a foundation for an effective digital talent strategy, start by asking these questions:

What share of current FTEs are currently dedicated to digital delivery work?

What share of current FTEs are capable of supporting digital delivery work?

How many current employees in traditional finance roles can we realistically upskill to support digital delivery work in the near future?

How much support can IT provide to finance (and other functions) to prepare employees to own digital delivery work?

How much outside talent can we attract to support digital delivery work within finance?

Once these questions are answered, begin the ongoing work of attracting, developing and retaining digital competencies. This work is critical, as the costs of digital staff attrition are roughly 69% higher than comparable turnover costs for core finance staff.

Digital finance talent holds different expectations from core finance talent. When creating a talent acquisition and retention strategy, consider the following factors:

Digital talent wants the freedom to innovate. But this often runs counter to the concerns of managers who are reluctant to fail or waste resources. It’s imperative to work with the management team to define the worst possible outcomes for an initiative and determine how to prevent or lessen the consequences of those outcomes. Then detail the benefits of pursuing the innovation and costs of inaction over the short and long term.

Top technology attracts top digital talent. According to a recent Gartner survey, the “technology level” at an organization is the most important employee value proposition (EVP) attraction driver for digital finance talent when they evaluate a potential employer.

A sense of belonging retains top digital talent. The biggest driver of digital finance talent’s intent to stay in the organization is the degree to which they feel a sense of belonging with the organization. Digital finance talent’s own values, tied to the digital transformation of the function, are often not held by their colleagues, especially in digitally immature organizations.

Strengthen digital talent’s connection to the purpose and possibilities of the finance function, as well as foster stronger personal connections. Specifically:

Include digital finance talent in bottom-up planning of digital initiatives.

Create flexible career paths to show digital finance talent they have a place in the future of the finance function.

Prioritize mutual learning between core and digital finance talent to strengthen the bond between groups.

Gartner CFO & Finance Executive Conference

Be a part of most important gathering for CFOs to explore potential finance tech providers and get actionable insights to prioritize technology innovation.

FAQ on digital finance

Why should businesses enable and optimize digital finance?

According to our research, 89% of board members said digital business is now embedded in all business strategies. CFOs need to steer digital transformation for their function to ensure technology investments align with the organization’s strategic business objectives.

By defining and delivering a digital finance strategy and roadmap, selecting the right finance technology vendors, managing technology costs and ROI, and driving technology adoption within the function, CFOs can ensure their organizations stay on track with digital transformation goals and are positioned to leverage digital technologies to improve decision making and streamline the finance function.

What are some emerging trends in digital finance?

A major trend occurring in the digital finance function revolves around finance talent. As part of a successful digital finance strategy, CFOs are increasingly addressing challenges within the finance organization in three key areas:

Securing digital finance talent: The pool of digital professionals with finance experience is extremely low and must be proactively addressed.

Productivity: In a recent Gartner study, 63% of finance executives reported that stress is affecting their productivity, which is higher than the average for other executives.

Development: Functional areas throughout the business compete with finance on attracting and retaining digitally dexterous talent. Outside of the organization, competition for talent is even tougher. Seventy-nine percent of CFOs feel confident in their teams’ willingness to learn new skills, while only 63% of finance staff said they feel confident they have the skills needed to do their job over the next three years.

What role does data analytics play in optimizing digital finance?

Slow growth, inflation, supply constraints and labor shortages continue to heighten pressure on margin and cash flow. As a result, finance leaders remain under pressure to effectively guide, support and enable both strategic and tactical decision making.

Business leaders need forward-looking insights, not just into what might happen next but also into what they should do. Accelerating the adoption of predictive and prescriptive analytics in finance is key to fulfilling these expectations.