Knowing the buying organization intimately is key for tech product leaders to drive high-quality, low-regret technology deals at scale.

- Gartner client? Log in for personalized search results.

Technology Buying Behavior: Who, Why and How

Steer the tech buying process

More tech purchase decisions are made by business leaders who lack experience with buying. As a result, sellers are more likely to face buying teams with unclear objectives and low momentum — often resulting in a low-quality deal. Sellers can use this guide to:

- Identify best-fit buyer types

- Take actions to steer the buying process

- Optimize the potential for a high-quality deal

Understand tech buying behavior to steer consensus

Providers must know what outcomes the organization is expecting and who is driving them in order to guide technology buyers through an effective buying process toward a high-quality deal.

- Why Tech Buyers Buy

- Who the Tech Buyer Is

- Who Funds the Purchase

- Tell a Value Story

Understand the strategic goals, desired outcome and urgency

High-quality technology deals start with consensus in the organization about the need the technology will meet and what value it will produce.

Gartner defines a high-quality deal as one in which the buying organization feels strongly that its expectations have been met, and they either purchased what they perceive to be a premium solution or they feel they did not settle for something less ambitious than what they had originally wanted.

Closing such deals requires product and go-to-market leaders at technology service providers (TSPs) to understand how the organization views the business value of technology overall and what value it hopes to deliver with the specific technology purchase.

Answering these questions can be challenging for many organizations, given the lack of experience decision makers have buying technology. As technology budgets have spread throughout the organization, buying expertise has dispersed, resulting in technology buyers that lack a clear understanding of the value a specific technology has and lack consensus with their team members on that value.

In those circumstances, the organization will often fail to buy at all, or make a purchase that they regret — postpurchase regret occurs in 80% of enterprise technology decisions.

Product and go-to-market leaders can combat these technology buying dynamics by understanding the buyer profile of the organization itself.

Identify the enterprise view of technology, the trigger, the need and the priority driving a technology purchase.

Start by understanding how the organization views the strategic business value of IT and use that understanding to clarify their goals for a specific technology. Goal clarity makes it easier to assess where the opportunity falls among the organization’s priorities, given competition for attention and resources.

In particular, verify the following four factors:

The organization’s view of the strategic value of IT helps define the enterprise buying persona. Does it view technology as critical to the business strategy or do they see it as an efficiency enabler? Do they prefer to play for the long term or seek short-term wins? What are their specific goals and how urgent are they?

The trigger is the event that raises awareness about the challenge or opportunity the organization hopes to address and motivates action. Triggers can be internal or external. They include renewal deadlines, new management, external advice on operating models, new regulations or a disruptive event such as COVID-19.

The goal is an outcome the organization wants to achieve. These goals could sit at the enterprise, business unit or initiative level. The goal is not usually about technology in and of itself. Instead, the idea is for the technology to help the organization execute on its goal.

The priority may be hard to see at first, but technology buying teams are more likely to be highly motivated when a tech purchase addresses organization-level strategic goals. Those needs that sit at the initiative or even business function level are at risk of being sidelined unless they clearly affect the organization’s ability to achieve its strategic goals.

Get to know the members of the buying team

There is no such thing today as a single stakeholder making an independent technology purchase decision. Enterprises now buy technology in teams, each with between 11 and 15 members.

Gartner sees this average buying team size regardless of the number of different functional areas participating. Counter to conventional wisdom, buying teams with more diverse functional participation are more likely to be clear on goals and typically make decisions faster. The diversity adds perspectives and experiences that help teams minimize mistakes and delays.

To learn about the buying team, answer the following questions:

Who benefits and whose help is needed?

The ideal buying team includes participation from the business areas that will benefit from the solution and other groups that can help to evaluate and implement the solution. These participants should be the targets for your marketing and sales efforts.

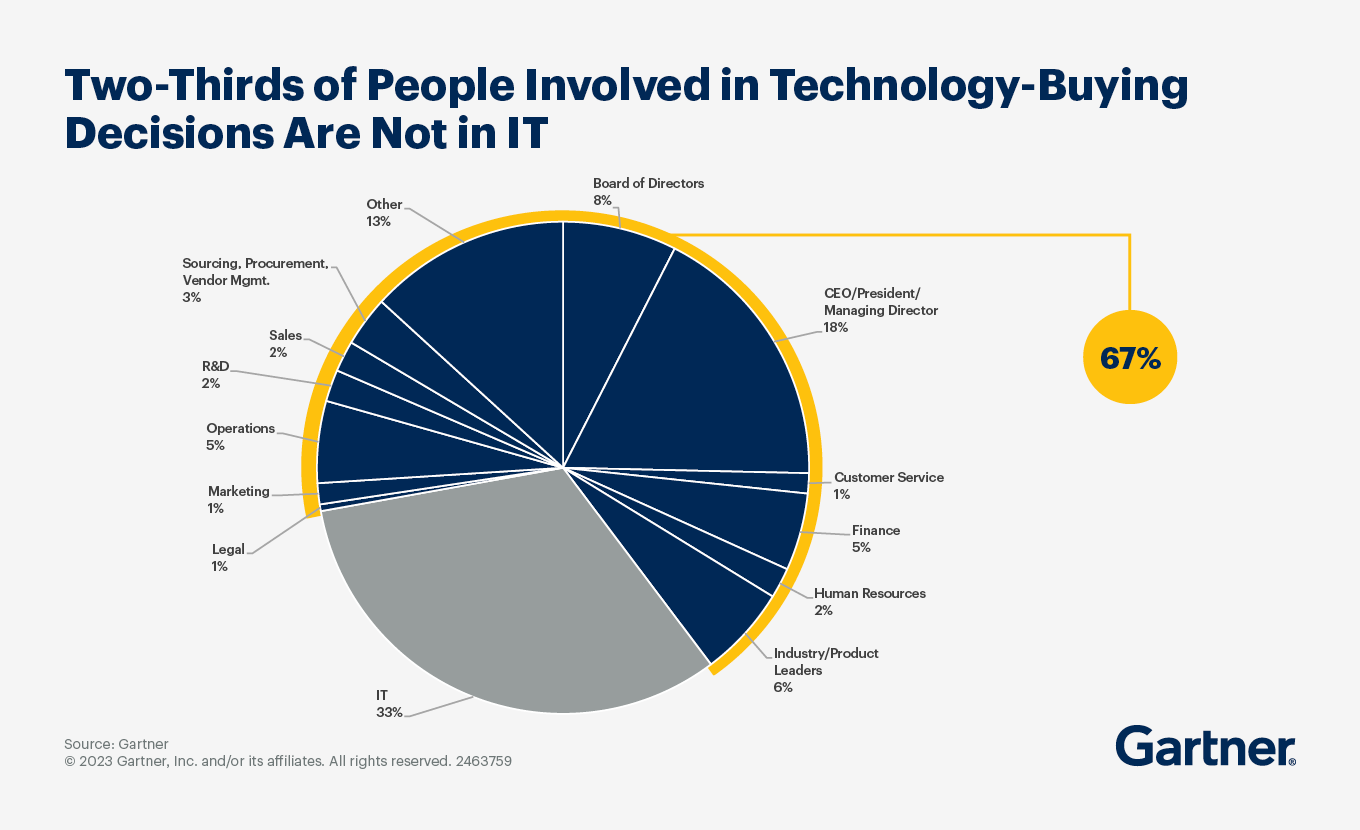

What functions do the buying team members work for?

As you work with the customer, you'll assess who is actually on their buying team as approaches are inconsistent. One or more buying team members are typically from the IT department. They play a critical role. Yet two-out-of-three buying team members today are not from IT. Instead, they are from the business unit that plans to use or will be affected by the technology. That may be finance, human resources, marketing, sales, customer service and support or supply chain, among others. Each team has its own buyer personas and priorities that show up in their technology buying behavior.

Stakeholder functions like procurement may also have a seat at the table, as could adjacent business units that will be affected by the buying function’s processes. This is ideal and product leaders can recommend buyers get these diverse team members involved, as it results in faster, better deals.

Is the member a decision maker, an influencer or an observer in tech buying decisions?

Only four or five of the technology buying team members are decision makers. The rest are either influencers or interested parties with no concrete decision-making authority. Product leaders must understand who the active members are and which of the influencers has real power.

Consider modern supply chain organizations, for example. They are increasingly digital and their technologies often touch other functional units, but the CEO is more likely to have veto power over a supply chain technology decision, than leaders of supply chain strategy or planning. A recent Gartner survey found that veto power sat with supply chain IT in 33% and with the Chief Supply Chain Officer in just 17% of organization. The CEO has veto power in just 7% of organizations and with supply chain strategy in just 5%.

Understanding those organizational and functional dynamics can help product leaders more effectively influence the buying process.

Know where the money sits and the technology buyer’s business case

Organizations that complete high-quality deals often know where the money is coming from for the technology purchase before they start conversations with service providers.

Consider these findings from Gartner research:

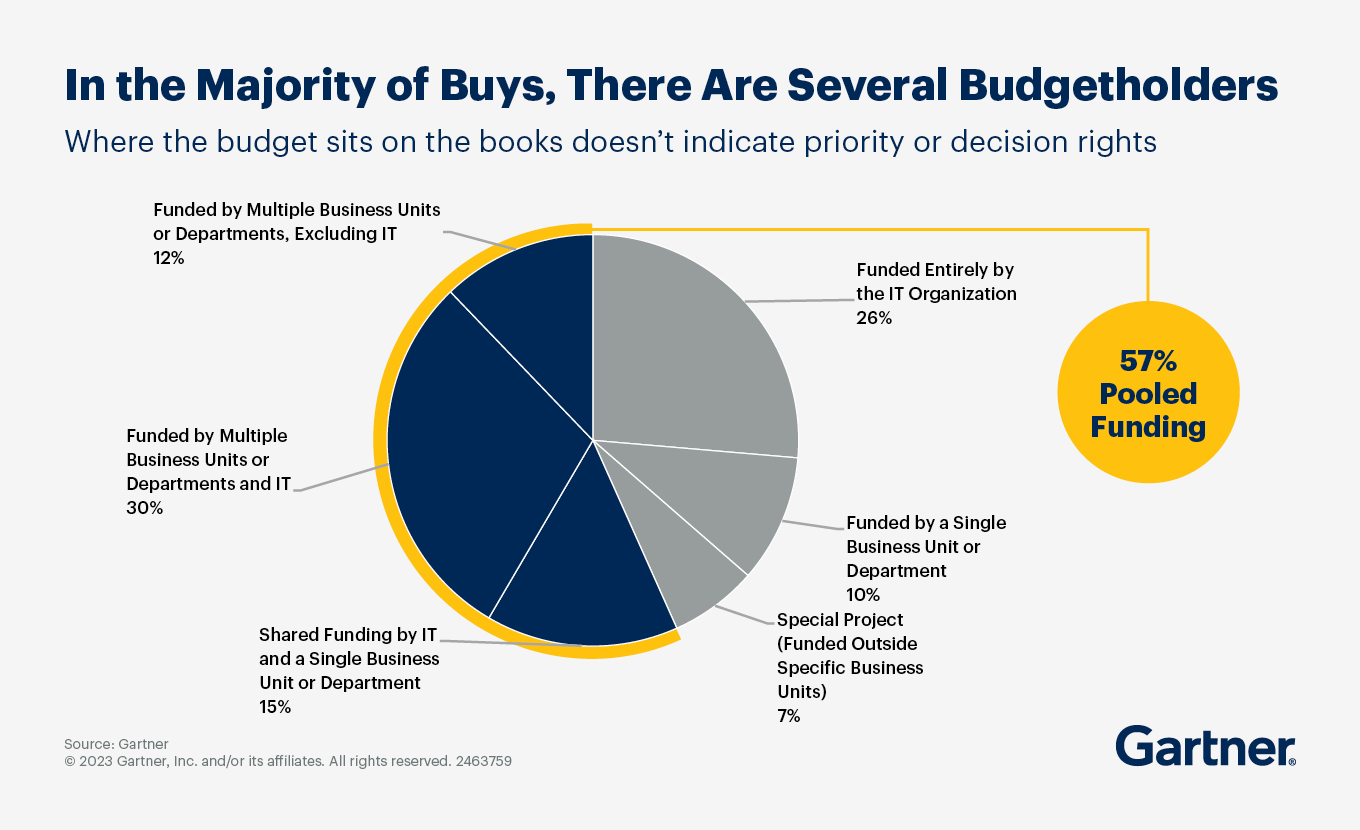

Fifty-seven percent of technology purchases come from pooled funding, meaning more than one business unit or function is paying for it.

In most cases, IT is one of the pooled funding contributors, but not in all.

IT also pays exclusively for about one-in-four technology purchases.

Knowing where funding comes from is crucial for tech service providers to identify their ideal customer profile (ICP). That key enterprise persona will have unique technology buying behaviors and decision processes you will want to understand and map out, so you provide helpful content or guidance to the buying team members along the way.

Money is not the only factor that dictates who has decision rights, however. It is still important to understand the balance of decision-making power and influence.

Accelerate purchase decisions when buyers face financial scrutiny.

Tech purchases also routinely come under scrutiny when budgets get reviewed or tightened, especially as finance executives are increasingly part of buying teams and processes.

Product leaders can help their buyers by providing them with information supporting the economic value and justification of potential purchases. For example:

Tie product and service offerings to related specific business outcomes to help champions build the business case.

Provide value assessment models and related metrics for sellers and buyers.

Mitigate buyer risk (and thus, potential additional cost) by providing buyer enablement and change enablement, which helps buyers build confidence in their ability to get value from the investment.

Construct a buyer-centric sales story

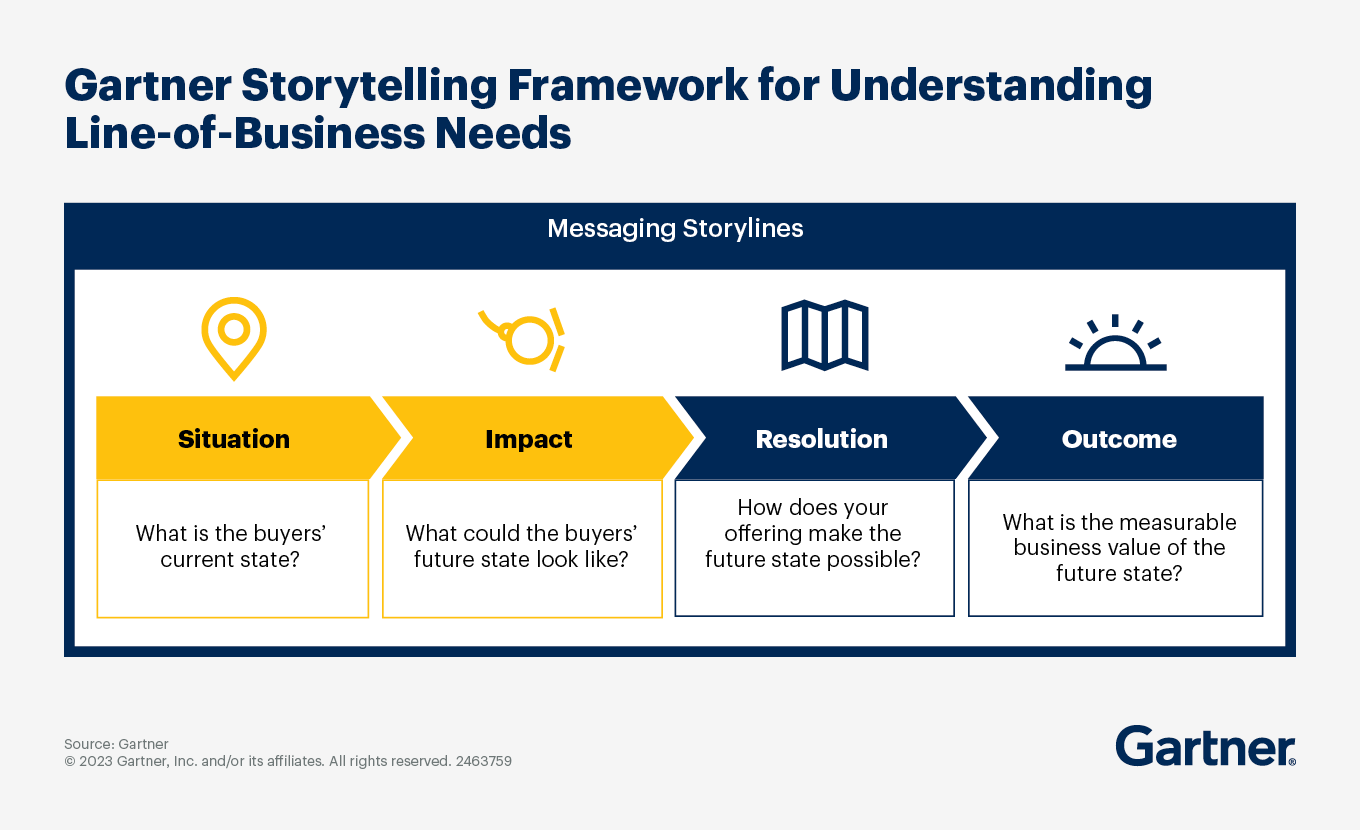

Even once you know who is buying and why, and who is paying, you need a compelling sales story to guide the buying process. An effective value story contains four parts: the situation, the impact, the resolution and the outcome.

Part I: Situation

Start by verifying that you understand the situation the buying organization is in — its current state. Include details such as, the key trends shaping the buyer’s business; strategic objectives associated with the goal; operational constraints that affect the buyer’s ability to achieve its strategic goals; external triggers; and key technologies that influence the decision.

Part II: Impact

Describe the impact of the status quo — the quantifiable consequences of the organization’s current situation. Does the organization have high costs compared to its competition? Is it inefficient? Is it losing out on business opportunities? Impact adds urgency by quantifying why change is needed.

You can articulate impact as a positive or negative. Either way, quantify the business impact or risk using metrics that matter to the members of the buyers team, such as how much growth or cost reduction could be achieved by deploying your solution.

Provide social proof in the form of customer success stories and real-world examples, and map out a realistic approach that will get the buyer from their current situation to this future state.

Part III: Resolution

The resolution maps “how” the organization will transition from its current situation to its future state. Demonstrate how your offering provides a compelling way forward.

Most important to address are:

How your whole product offering makes a better future state possible

What technical, industry or domain expertise you provide

How your team or partners help with change management

How you plan to evolve over time to continue to deliver value

Part IV: Outcome

Product leaders should describe the outcome in terms of the business value the organization will achieve. Product-centric outcomes are acceptable here, especially if they connect to the same types of metrics quantified in the impact section.

Given that the buying team will have members from different business units and at different levels in the organization, product leaders should be sure to articulate forms of value that resonate with each of the decision makers or influencers. Example outcomes could be increasing revenue or avoiding lost revenue, reducing costs, increasing productivity or process efficiency, improving quality, speed, or ease of work, assuring compliance and thus yielding cost savings by avoiding fines.

The top storylines differ depending on the business functions involved in the decision. For example:

Finance technology buying. Point product leaders toward stories that emphasize achieving financial performance during a market downturn, improving finance workforce management or the growing role finance plays in data and analytics.

HR technology buying. Stories may emphasize boosting employee retention, increasing workforce productivity and accelerating innovation to improve the candidate experience.

Gartner Tech Growth & Innovation Conference

Join the leading technology and service provider peers to get an update on accelerating tech growth in a new era of transformation and technology trends.